What is the Crypto J-Curve?

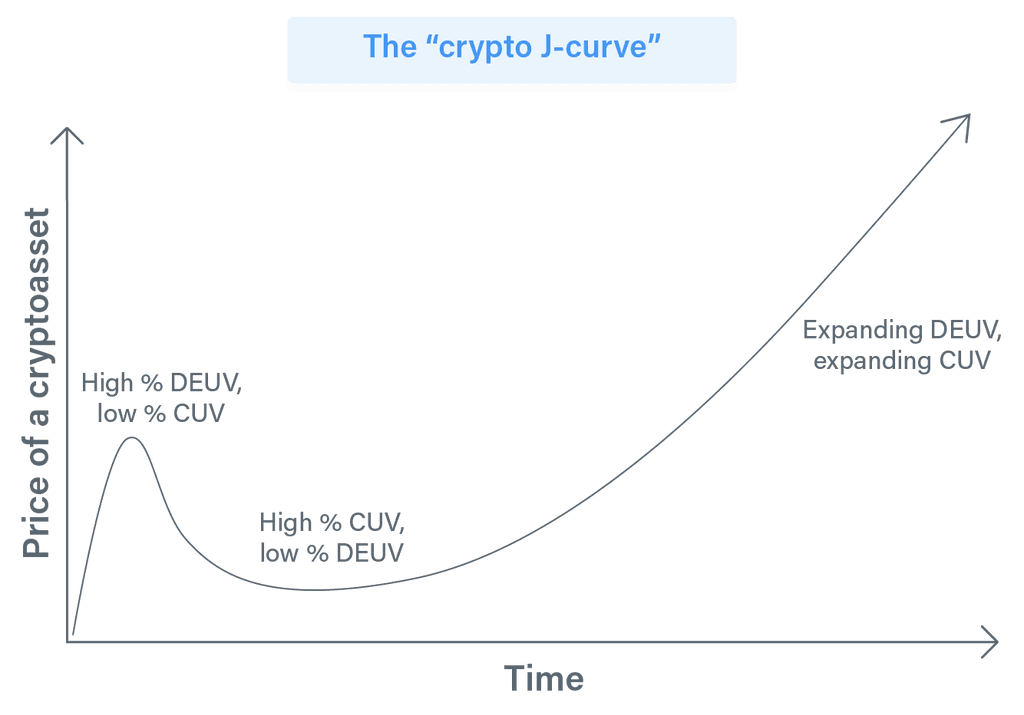

The crypto J-curve models how the market values a cryptocurrency over time. Usually, upon an ICO, or its initial listing on a major exchange, enthusiasm for a crypto asset is high. It typically continues to moon (or boom) for a while. Yet, during this time, the utility value of the coin is usually minimal, or even non-existent.

As the coin gets utilised by others, potholes in the road appear, which the developers tried to patch up as quickly as possible. But enthusiasm wanes, and with that the value of the coin. However, as improvements are made to the protocol, things tick up again, drawing out a pattern in the shape of a ‘J’.

We introduced the equation of exchange in the post on crypto asset valuation. This model was conceived by Chris Burniske. However, he didn’t stop there and has extended the model further to form the ‘Crypto-J-curve’ hypothesis.

Step 1: Utility Management

Burniske uses the discounted present value to measure the token utility. He assumes a specific maturity date, T, then proxies the token utility value by that date (in USD), finally discounting it back to today.

Step 2: CUV and DEUV, and What They Are

Burniske further decomposed the token price into ‘Current Utility Value’ (CUV) and ‘Discounted Expected Utility Value’ (DEUV).

The idea is that a token’s value consists of both:

- the value as if it can be used today

- the value as if it will be widely adopted in the future

The Crypto J-Curve in Action

Burniske believes that the enthusiasm for a crypto asset will initially be high and typically continues to grow for a while. In this period, the CUV of the asset is minimal, or non-existent if there’s no protocol. The asset is then largely composed of DEUV.

As the crypto assets progress through time, the enthusiasm may wane, weighing on the DEUV. Since the system is not yet mature, the CUV is low, and a high % of CUV presents a low valuation price.

The system will gradually mature with increased use, and the CUV of a crypto asset grows quietly. A growing CUV can occur even as the DEUV of the token continues to compress. If the market is bearish enough, the price of the asset may compress DEUV all the way to zero, leaving only CUV, and a drastically diminished price. Potentially, the market may even discount the asset to the point of trading below CUV, somewhat akin to a stock trading beneath book value.

The system will eventually reach a mature point where both CUV and DEUV are expanding, completing the whole market cycle.

Although the valuation model and the Crypto-J-curve provides a practical framework for analysing crypto assets, we would like to point out some problems and concerns with the model:

1. Arbitrary maturity date chosen

In Burniske’s example, he has used 30 years as maturity date. What if the token is more short or mid term focused? With a high discount rate (e.g. 30%), picking 10 years vs 30 years can significantly affect the result due to discounting.

2. Only single use case are allowed

Burniske assumed only one use case in his example. What if the token has more than one utility or use case?

3. It is hard to measure utility value in USD

Many arbitrary assumptions were introduced, including target addressable market and adoption curve.

4. An arbitrary discount rate

The discount rate has significant impact on the discounted utility, yet no sound methodology for calculating the discount rate is provided. Burniske subjectively picks 30% as the discount rate in his example.

5. Technological soundness is not considered

No factors are considering the technological soundness/platform and team capabilities.

6. The probability of failure

Projects may fail due to technology, execution, accidents, etc.

Is the Crypto J Curve Useful?

To conclude, Burniske provided one of the first crypto asset valuation models, which may provide directional insights for token valuation. It won’t give you a good estimate for exact token prices, but it has use as as a general roadmap for a token’s development.

How to Fully Understand the Value of Your Crypto

This post on the Crypto J-Curve completes a four-part series we created on cryptoasset valuation. You can also learn the 101 of crypto valuation, TradFi asset valuation tools, and other cryptoasset valuation models in the other pieces of our series for a deep dive and DYOR (do your own research) on what your crypto is really worth.

No comments:

Post a Comment